Florida

Our Continuing Education courses are all State-approved.

OnLine Training strives to provide high quality continuing education

online, online CPE, and other online training courses at an affordable

price. We treat each of our students individually while providing a

quality insurance education available online 24 hours a day 7 days a

week to professionals and businesses.

Insurance Agents need Continuing education to stay current with the latest

developments, skills, and laws. Continuing Education is also required to comply with laws, remain licensed or certified.

Choose Your CE Course From The Menu And Enroll Today.

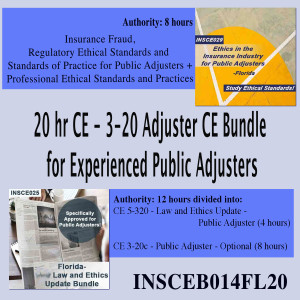

20 hr CE - 3-20 Adjuster CE Bundle for Experienced Public Adjusters (INSCEB014FL20)

NOTE: This bundle is a 20hr bundle of CE. It meets your complete required number of hours if you have held your license for six (6) years or more. If you have not had your license for that amount of t..

$45.00 Incl. Tax: $45.00

24 hr CE - 3-20 Adjuster CE Bundle for Newer Public Adjusters (INSCEB015FL25)

We are pleased to announce our new bundle package of 25 hours of 3-20 Public Adjusters Continuing Education Insurance courses offered at a special price, all State-approved by the Florida Department o..

$47.00 Incl. Tax: $47.00

10hr CE - Customer Service Representative 4-40 CE Bundle (INSCEB017FL10)

All 4-40 Customer Service Representatives are required by law to have 10 hours of CE credits completed every two years; this is a quick and easy way to get all your hours in one easy registration pr..

$40.00 Incl. Tax: $40.00

20 hr CE 6-20 Adjuster CE Bundle for Experienced All-Lines Adjusters (INSCEB016FL20)

We are pleased to announce our new bundle package of 20 hours of 6-20 All Lines Adjusters Continuing Education Insurance courses offered at a special price, all State-approved by the Florida Depar..

$45.00 Incl. Tax: $45.00

20 hr CE - Property and Casualty CE Bundle for Experienced 2-20 or 20-44 Agents (INSCEB013FL20)

We are pleased to announce our new bundle package of 20 hours of Experienced General Lines Agent Continuing Education Insurance courses (applicable to 2-20 and 20-44) offered at a special price, a..

$45.00 Incl. Tax: $45.00

20 hr CE - Health and Life CE Bundle for Experienced 2-15, 2-14 or 2-40 Agents (INSCEB024FL20)

We are pleased to announce our new bundle package of 20 hours of Experienced Agent Health and Life (2-15, 2-14 and 2-40) Continuing Education Insurance courses offered at a special price, all State-ap..

$45.00 Incl. Tax: $45.00

24 hr CE 6-20 All-Lines Adjusters Complete CE Bundle (INSCEB019FL24)

We are pleased to announce our new bundle of 24 hours of 6-20 All Lines Adjusters Continuing Education Insurance courses offered at a special price, all State-approved by the Florida Department of Fin..

$47.00 Incl. Tax: $47.00

24 hr CE - 2-15, 2-14 or 2-40 Health and Life Complete CE Bundle (INSCEB023FL24)

We are pleased to announce our new bundle of 24 hours of Health and Life (2-15, 2-14 and 2-40) Continuing Education Insurance courses offered at a special price, all State-approved by the Florida Depa..

$47.00 Incl. Tax: $47.00

3 hr All Licenses CE - Homeowners Insurance - What's Covered, What's Not? (INSCE039FL3)

Insurance Claims Adjusters and Public Adjusters need a deep understanding of the homeowner policy to determine what’s covered and what’s not. Insurance Agents and CSRs also benefit from knowing ..

$27.00 Incl. Tax: $27.00

3 hr Public Adjuster CE (3-20) - Homeowners Insurance - What's Covered, What's Not? (INSCE039FL3)

Insurance Claims Adjusters and Public Adjusters need a deep understanding of the homeowner policy to determine what’s covered and what’s not. Insurance Agents and CSRs also benefit from knowing ..

$27.00 Incl. Tax: $27.00

4-hour Law & Ethics Update Plus - 3-20 Public Adjusters (5-320) CE Course (12 hrs credit) (INSCE025FL12j)

This class satisfies the requirement that Public Adjusters complete a Law and Ethics Update course specifically approved for Public Adjusters every 2 years, which is specific to the license held by th..

$44.00 Incl. Tax: $44.00

Insuring the Small Business (CE) (INSCE015FL3)

This class is available for all insurance agents for CE credit, but was written especially for Commercial Lines Agents and Customer Service Reps who specialize or want to specialize in serving the s..

$27.00 Incl. Tax: $27.00

2 hr All Licenses CE - COVID-19, Insurance, and Claims (INSCE038FL2)

COVID-19 claims have raised coverage issues that will probably ultimately resolved through legislation and court decisions. Coverages affected include property, general liability and workers c..

$27.00 Incl. Tax: $27.00

2 hr Public Adjuster CE (3-20) - COVID-19, Insurance, and Claims (INSCE038FL2)

COVID-19 claims have raised coverage issues that will probably ultimately resolved through legislation and court decisions. Coverages affected include property, general liability and workers compens..

$27.00 Incl. Tax: $27.00

4-hour Law & Ethics Update 2-15 CE Course - for 2-14, 2-15, 2-40 Life and Health Agents (INSCE018FL5j)

This class satisfies the requirement that 2-14, 2-15, and 2-40 Agents complete a Law and Ethics Update course every 2 years, which is specific to the license held by the licensee and covers industry l..

$34.00 Incl. Tax: $34.00

4-hour Law & Ethics Update 6-20 All-Lines Adjusters (5-620) CE Course (9 hrs credit) (INSCE024FL9j)

This class satisfies the requirement that Adjusters complete a Law and Ethics Update course every 2 years, which is specific to the license held by the licensee, and covers Regulatory awareness, Licen..

$39.00 Incl. Tax: $39.00

4-hour Law and Ethics Update PC2 - 2-20 and 20-44 Agents and 4-40 CSRs (9hrs credit) (INSCE030FL9j)

This class satisfies the requirement that Agents complete a Law and Ethics Update course every 2 years, which is specific to the license held by the licensee and covers industry law updates, premium d..

$35.00 Incl. Tax: $35.00

10hr CE - Customer Service Representative 4-40 Complete CE Bundle (INSCEB004FL10)

All 4-40 Customer Service Representatives are required by law to have 10 hours of CE credits completed every two years; this is a quick and easy way to get all your hours in one easy registration pr..

$40.00 Incl. Tax: $40.00

6 hr all Licenses CE - Surplus Lines (INSCE036FL6)

The Surplus Lines Agent License (1-20) allows the licensee to handle the placement of insurance coverages with unauthorized insurers and to place such coverages with authorized insurers as to which th..

$34.00 Incl. Tax: $34.00

Long-Term Care NAIC 4-hour Refresher Class: Partnership Programs, LTC Insurance and LTC Services (INSCE035FL4)

This 4-hour Continuing Education course is entitled "Long-Term Care NAIC 4-hour Refresher Class: Partnership Programs, LTC Insurance and LTC Services." This class is written to satisfy the NAIC requir..

$32.00 Incl. Tax: $32.00